Global Midwest Alliance

888.808.0462

Driving Innovation and Growth

NEWS ARTICLE

April 1, 2019

GLOBAL MIDWEST ALLIANCE HOSTS SUCCESSFUL CORPORATE VENTURING PROGRAM FOCUSED ON CORPORATE DRIVEN INNOVATION

By George Vukotich, FinTank

The 4th Annual Midwest Corporate Venturing Program, Corporate Venture Driven Innovation, hosted by Global Midwest Alliance, program host Polsinelli and sponsor, Square 1 Bank, set a record for the largest group of attendees in the program's history.

The program included an opening reception of Midwestern trailblazers, including Jason Blumberg of Energy Foundry, Allen Dines of WISC Partners, and Troy Vosseller of Gener8tor, who explored the intersection of corporate innovation and the growth of accelerators around the country. The insights shared kicked the program off and inspired the audience of entrepreneurs and corporate venture capitalists. The reception was hosted at mHUB, an innovation center for physical product development and manufacturing headquartered in Chicago, and included a tour of the facility for program attendees.

The program opened with a fireside chat moderated by Shez Bandukwala, Managing Director of Investment Banking at KPMG Corporate Finance LLC, and keynote speaker, Reese Schroeder, Managing Director of Tyson Ventures. The keynote focused on Reese’s work at Tyson, where he has built the portfolio for a $150 million fund. Previously, he spent 28 years in leading roles at Motorola, including running the corporate venture group. Reese shared insights from his more than 200 investments over the years. At Tyson, the fund he has built is a multi-stage fund, focusing on Series A through C, with a targeted investment of from $2-5 million in return for 5-15%. His described his process for building a successful fund, as well as his review and approval process which involves Tyson’s general counsel and CEO.

Following the insights from Reese, Adam Weiss, a Shareholder from the national law firm, Polsinelli, facilitated a panel of six innovative start-ups that featured their various innovations and the opportunities in which they are currently involved. These companies included:

- AirShare is a Canadian company that designs and manufactures drone interceptors and control systems to detect, track and safely mitigate wayward or malicious drones,

- FLEx’s Lighting is an Illinois company whose technologies have created the world’s thinnest lighting system that provides critical lighting solutions for the rapidly expanding category of Reflective LCDs to enhance the viewability and extend battery life of mobile, wearable and flexible devices of the future.

- The Healthy Grain is an Australian company that is a leader in the provision of natural, nutritionally dense, patented wholegrains that enhance the health and well-being of people worldwide.

- NanoGraf is a U.S.-based battery materials venture that is developing silicon-graphene anodes for the next generation of lithium-ion batteries that offers higher battery capacity and faster charging rates, all while being produced via a low cost solution chemistry-based manufacturing process.

- Savormetrics is a Canadian company that produces AI-driven portable sensing devices that provide food companies with meaningful food safety and quality metrics using real time sensing technologies.

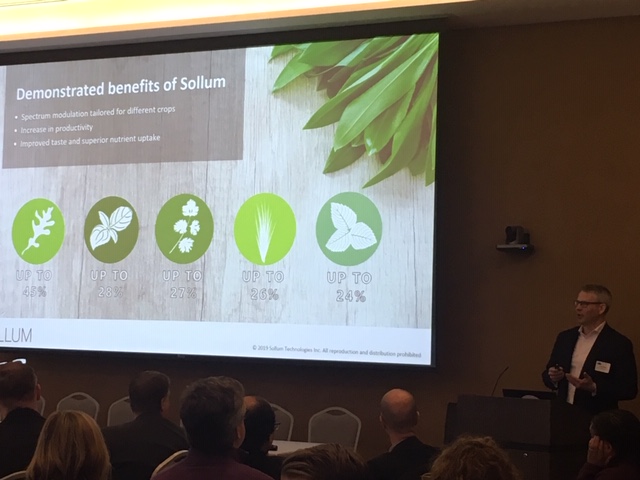

- Sollum Technologies is a Canadian company revolutionizing greenhouse lighting to create optimal growing conditions that increases crop yield and improves efficiency

The questions and comments from the audience created an interactive session which led to many information exchanges and potential opportunities for further deal-making.

Finally, Karen Kerr, Ph.D., Executive Managing Director at GE Ventures, led a panel that gave attendees a behind-the-scenes look at corporate venture deal-making and partnerships. Brian Schettler, Managing Director at Boeing HorizonX Ventures and CEO Duncan McCallum, CEO of Digital Alloys, shared insights into their investment relationship. Michael Young, General Manager of Caterpillar Ventures, and Saikat Dey, CEO of Guardhat, discussed how their deals came about, as well as what works well and potential issues to avoid. The panel discussed the fact that corporate venturing, unlike angel investing, does not solely look at the ROI on the investment, but rather, the partnership and what it means to the growth of the companies and innovation that the start-ups bring to the larger firms.